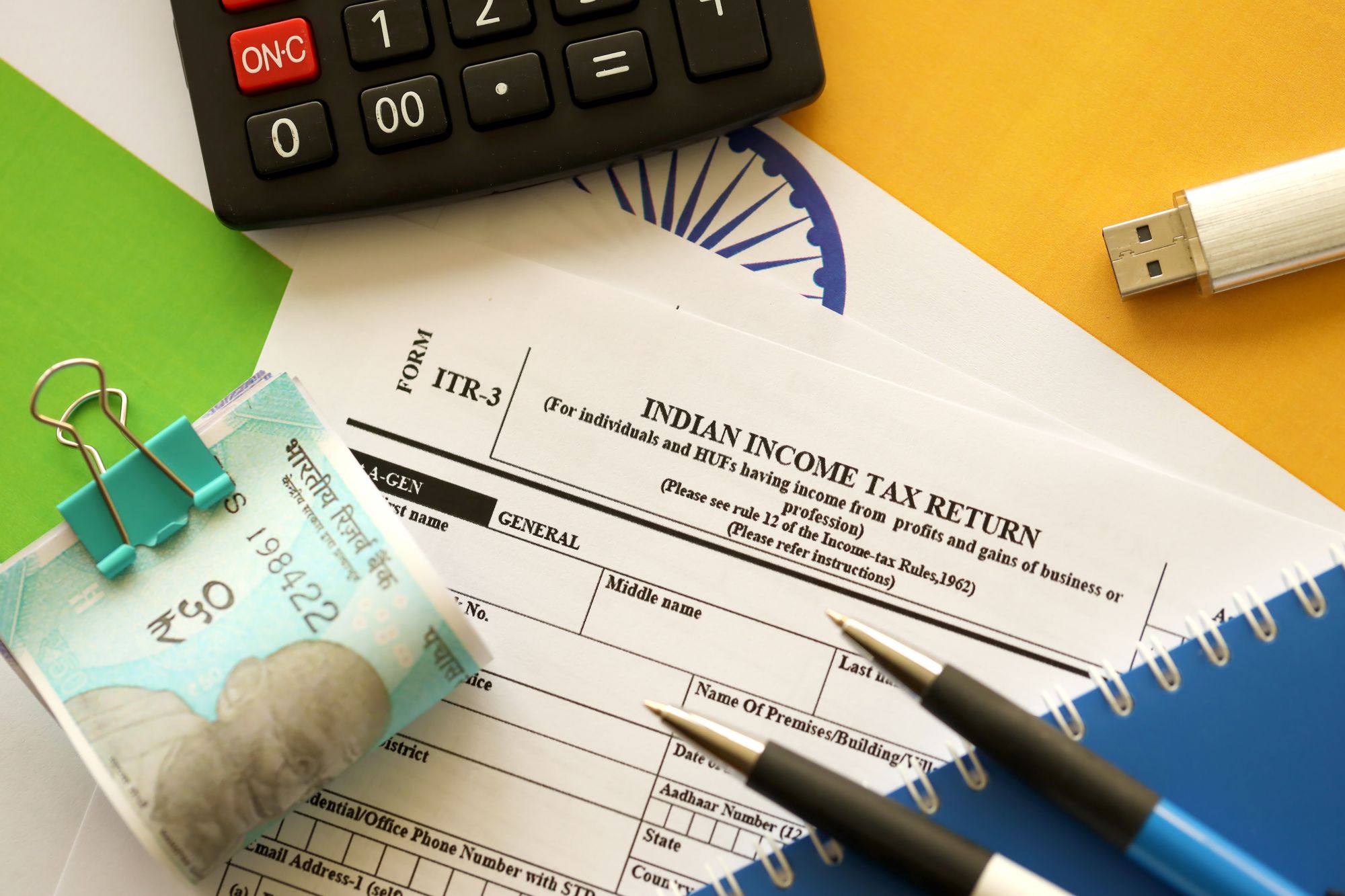

ITR Filing 2023: Which ITR to File? (ITR 1/2/3)

As the financial year draws to a close, taxpayers across India are getting ready for the annual tradition of filing their income tax returns (ITRs).

But let's face it, the whole process of ITR filing can be quite overwhelming, especially with a bunch of different ITR forms to choose from.

No worries, though!

We've got your back with a complete guide to help you figure out the perfect ITR form for the Assessment Year 2023-24 (Financial Year 2022-23).

So whether you're an individual, a business owner, or a professional, keep reading to discover which ITR form suits you like a glove.

ITR-1: Perfect for Salaried Individuals and HUFs with Limited Income Sources

Meet ITR-1, fondly known as Sahaj, the most basic ITR form that caters to salaried individuals and Hindu Undivided Families (HUFs) who meet specific criteria.

If you fit into any of these categories, ITR-1 is the form you've been searching for:

a) Income Sources Allowed

ITR-1 is custom-made for individuals with income from the following sources:

1. Salary or Pension

2. Income from one house property

3. Income from other sources (but sorry, lottery or gambling winnings are not invited!)

b) Income Limit

To get cozy with ITR-1 during the Assessment Year 2023-24, your total income should be up to Rs. 50 lakhs.

However, if you have income from more than one house property, agricultural gains above Rs. 5,000, or winnings from lotteries or racehorses, it's a no-go for ITR-1.

c) Who Cannot File ITR-1

The ITR-1 party is off-limits to the following guests:

1. Non-resident individuals (NRIs)

2. Directors of companies

3. Owners of investments in unlisted equity shares

4. Individuals with total income exceeding Rs. 50 lakhs

5. Those seeking double taxation relief under Section 90/90A/91

Summary: If you're a salaried individual or part of an HUF with limited income sources, and your total income is up to INR 50 lakhs, go for ITR-1.

ITR-2: Your Ticket to a World of Income Sources

ITR-2 steps up as a more all-encompassing alternative when compared to ITR-1.

It's the perfect fit for individuals and HUFs who don't quite fit into the ITR-1 category but have a diverse range of income sources.

So, if any of these situations sound like you, ITR-2 is the form that's got you covered:

a) Variety of Income Sources

ITR-2 includes all the income sources mentioned in ITR-1, and it doesn't stop there!

It goes the extra mile by covering earnings from capital gains, foreign assets/income, and even agricultural income exceeding Rs. 5,000.

Plus, if you've got more than one house property, ITR-2 welcomes you with open arms.

b) Calling All NRIs and Foreign Asset Holders

Hey there, NRIs with income earned in India or assets within the country!

You're cordially invited to the ITR-2 affair. And not just you, individuals with foreign assets or income outside India need to RSVP using ITR-2 to declare all those fancy details.

c) Who all are not invited?

Sorry, business owners and professionals, the ITR-2 gala is not for you!

If you have income from a business or profession, you should be heading to the ITR-3 extravaganza, which we'll talk about next.

Alright, now that we've covered ITR-2, let's move on to the next exciting event in the income tax world!

Remember to keep it real and file the appropriate ITR form to make your tax journey a smooth and memorable one. Happy filing!

Summary: In case you have income from various sources like capital gains, foreign assets, or agricultural income above INR 5,000, and ITR-1 is not applicable to you, then ITR-2 is your best choice.

ITR-3: The VIP Party for Business Owners and Professionals

Welcome to the most exclusive event in the tax world – ITR-3!

This party is dedicated solely to individuals and HUFs who rake in the moolah from their very own businesses or professions.

Calling all freelancers, doctors, lawyers, consultants, and talented professionals – if your income comes from what you love doing, the ITR-3 soirée is where you want to be.

Here's the lowdown on this fabulous gathering:

a) Income Sources Allowed

ITR-3 pulls out all the stops by covering all income sources mentioned in ITR-2.

On top of that, it even includes income earned through a business or profession.

So, if you're the mastermind behind your own venture, ITR-3 is the perfect choice for you.

b) Partnership Firms and LLPs

Partners of partnership firms or Limited Liability Partnerships (LLPs) that have their financial matters sorted with income tax returns should definitely get their names on the guest list for ITR-3.

But here's a little secret: if the firm or LLP doesn't need to file a return, partners can gracefully RSVP using ITR-2 instead.

c) Who Cannot File ITR-3

To those without any income from a business or profession, we apologize for not sending you an invite to the ITR-3 extravaganza.

Not to worry though – you can always check out ITR-1 or ITR-2, depending on the sources of your income.

So, get ready to rock the ITR-3 party if you're a business owner or a professional. And for everyone else, there's an ITR form that suits you just right. Cheers to a stress-free tax season!

Summary: For business owners or professionals with income from a business or profession, ITR-3 is the way to go.

Before you go…

Filing your income tax returns can feel like an annual tradition that all eligible taxpayers need to go through.

However, it doesn't have to be a daunting task if you know which ITR form is the right fit for you.

And here's a friendly reminder: When you're unsure about which ITR form suits you best or if your financial situation is a bit complex, don't hesitate to seek help from a tax expert.

Their expertise will guide you through the process with ease. Happy filing, and may your tax journey be smooth and compliant!

We hope this blog post helps you and we shall see you soon!

Apna app is trusted by 4lakh+ companies and 5Crore+ happy job seekers. It helps job seekers in finding their dream job according to candidate’s convenience and offers great opportunities in various categories like telesales, marketing, business development, accounts & finance and many more.